Art Transfers $5000 From His Checking Account to His Savings Account This Transaction Will

two.5 T-accounts, debits and credits

What practice all accounts look like in a double-entry system?

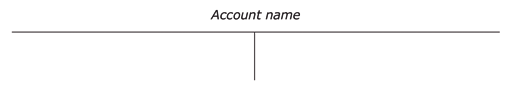

Traditional double-entry accounting divides every account into two halves as follows:

This T advent has led to the convention of ledger accounts being referred to equally T-accounts.

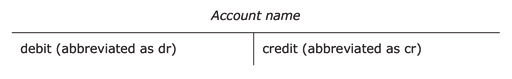

Convention, which has not changed for hundreds of years, prescribes that the left-hand side of a T-business relationship is called the debit side, and the correct-paw side is called the credit side.

What is the main reason that all accounts are divided into a left or debit side and a right or credit side?

Equally we take seen in Sections two.three and 2.4, because of the dual aspect of double-entry bookkeeping, if one account changes equally a result of a financial transaction, and so another account needs to change to go along the bookkeeping equation in balance. This is shown in ledger or T-accounts past recording each transaction twice, once as a debit-entry in 1 business relationship and once as a credit-entry in another business relationship. This is done according to time-honoured rules which care for asset accounts differently from liability accounts and the uppercase account.

What are the rules of double-entry bookkeeping?

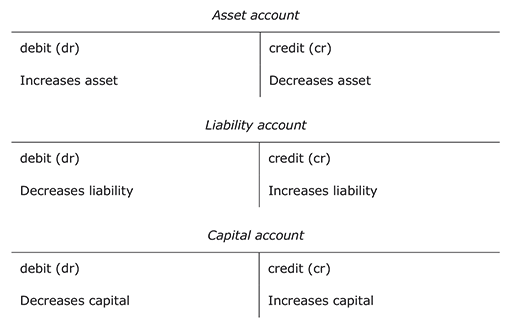

If a transaction increases an nugget account, then the value of this increase must be recorded on the debit or left side of the asset business relationship. If, however, a transaction decreases an asset business relationship, then the value of this decrease must exist recorded on the credit or right side of the asset account. The converse of these rules applies to liability accounts and the capital account, as shown in the three T-accounts below:

Pause for thought

These rules need to be memorised initially as they are non intuitive. Through seeing how they work in practise and doing exercises they will become 2d nature – a picayune bit similar learning to swim or ride a bike.

The balance on an nugget account is ever a debit balance. The residual on a liability or capital account is ever a credit remainder. (Later on in this department you will learn how to work out the concluding or endmost rest on an account which has both debit and credit entries. The procedure of determining the endmost rest on an business relationship is known every bit 'balancing off ' an account.)

The best fashion to empathise how the rules of double-entry accounting work is to consider an case. We will now record the six transactions carried out by Edgar Edwards Enterprises in the appropriate T-accounts.

Example

Transactions:

- The owner starts the business with £v,000 paid into a business bank account on one July 20X2.

- The business organization buys article of furniture for £400 on credit from Pearl Ltd on 2 July 20X2.

- The business concern buys a reckoner with a cheque for £600 on iii July 20X2.

- The concern borrows £five,000 on loan from a banking concern on 4 July 20X2. The money is paid into the business banking company account.

- The business concern pays Pearl Ltd £200 by cheque on 5 July 20X2

- The owner takes £fifty from the bank for personal spending on six July 20X2.

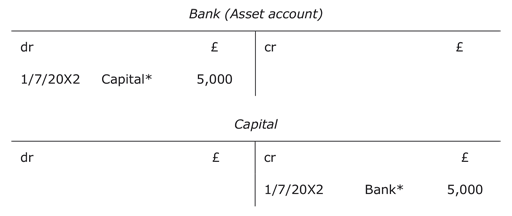

Transaction ane : The owner starts the business with £v,000 paid into a business banking company account on 1 July 20X2. (Post-obit the rules we learnt, we thus need to debit an asset account and credit the capital account.)

* Each T-account, when recording a transaction, names the corresponding T-account to prove that the transaction reflects a double entry in the nominal ledger.

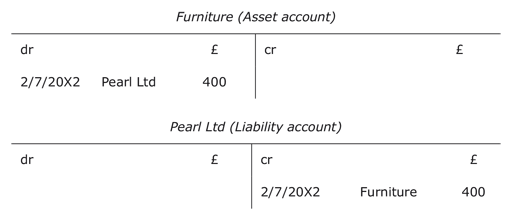

Transaction 2 : The business concern buys furniture for £400 on credit from Pearl Ltd on 2 July 20X2. (Nosotros need to debit an asset account and credit a liability account.)

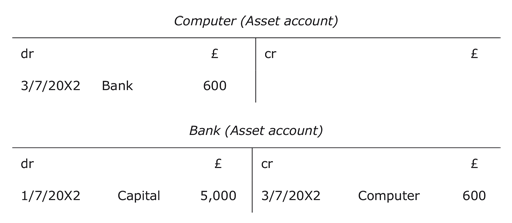

Transaction three : The business organisation buys a estimator with a cheque for £600 on 3 July 20X2. (We need to debit an asset business relationship and credit an asset account.)

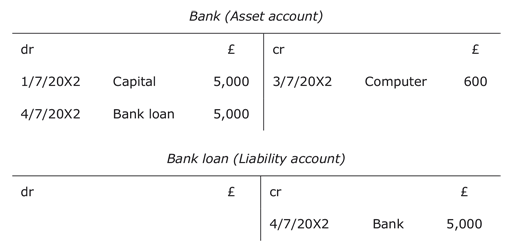

Transaction iv : The business borrows £5,000 on loan from a banking company on four July 20X2. The coin is paid into the business organization bank account. (We need to debit an asset account and credit a liability account.)

Transaction five : The business pays Pearl Ltd £200 by bank check on 5 July 20X2. (Nosotros need to debit a liability account and credit an asset business relationship.)

Transaction 6 : The owner takes £50 from the bank for personal spending on 6 July 20X2. (We need to debit the majuscule account and credit an nugget account.)

In Section 2.iii nosotros recorded the consequences of these transactions in a remainder sheet for Edgar Edwards Enterprises dated 6/vii/20X2. Did you find it easy to do that? As there were only half dozen transactions, it was probably not too difficult. Yet, many enterprises take to record hundreds of transactions per twenty-four hour period. Having private T-accounts within the nominal ledger makes it much easier to collect the information from many different types of transactions. The adjacent section will explain what is washed with the balances in each of these accounts.

Source: https://www.open.edu/openlearn/money-business/introduction-bookkeeping-and-accounting/content-section-2.5

0 Response to "Art Transfers $5000 From His Checking Account to His Savings Account This Transaction Will"

Enregistrer un commentaire